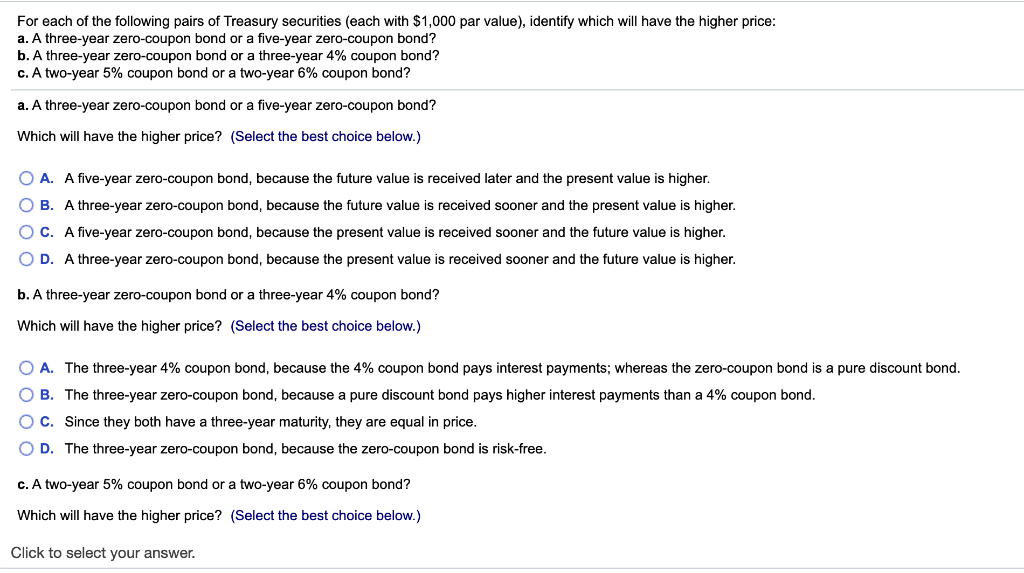

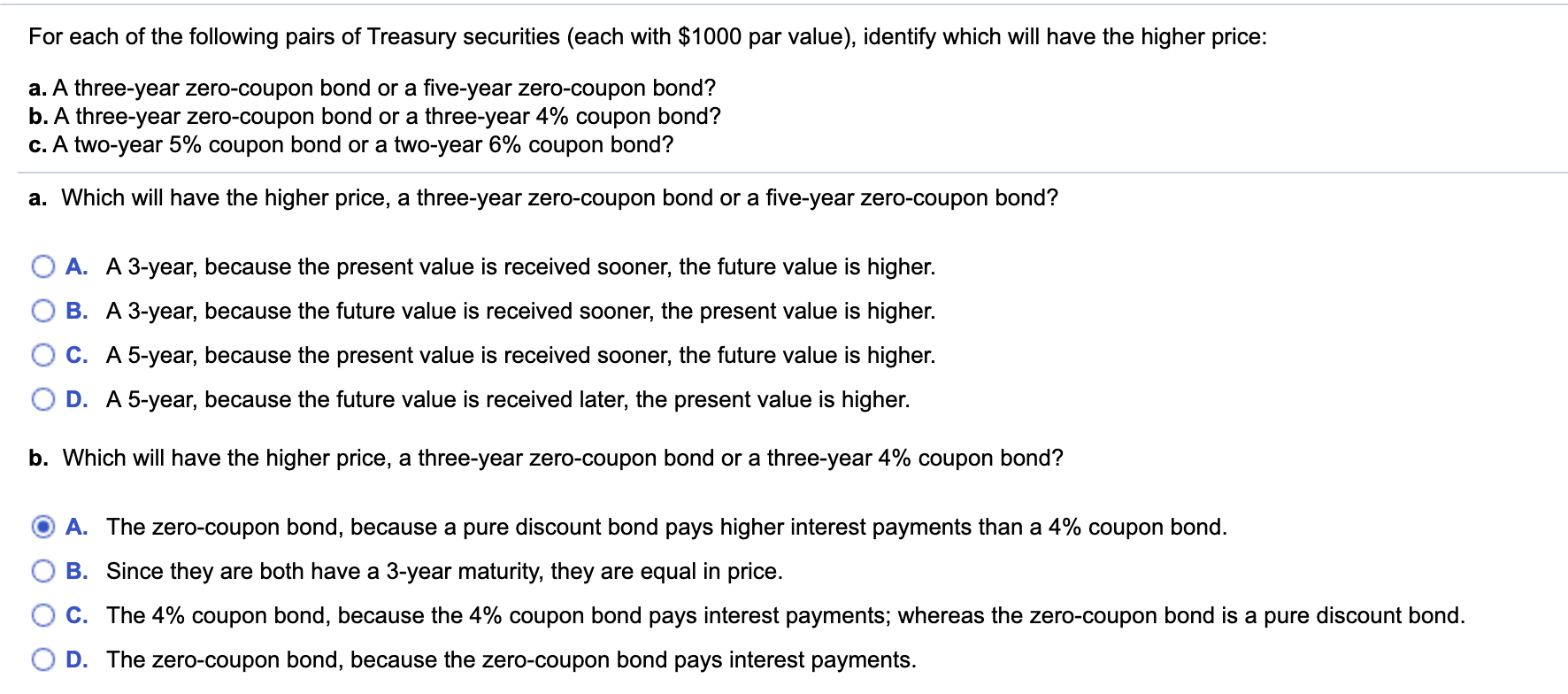

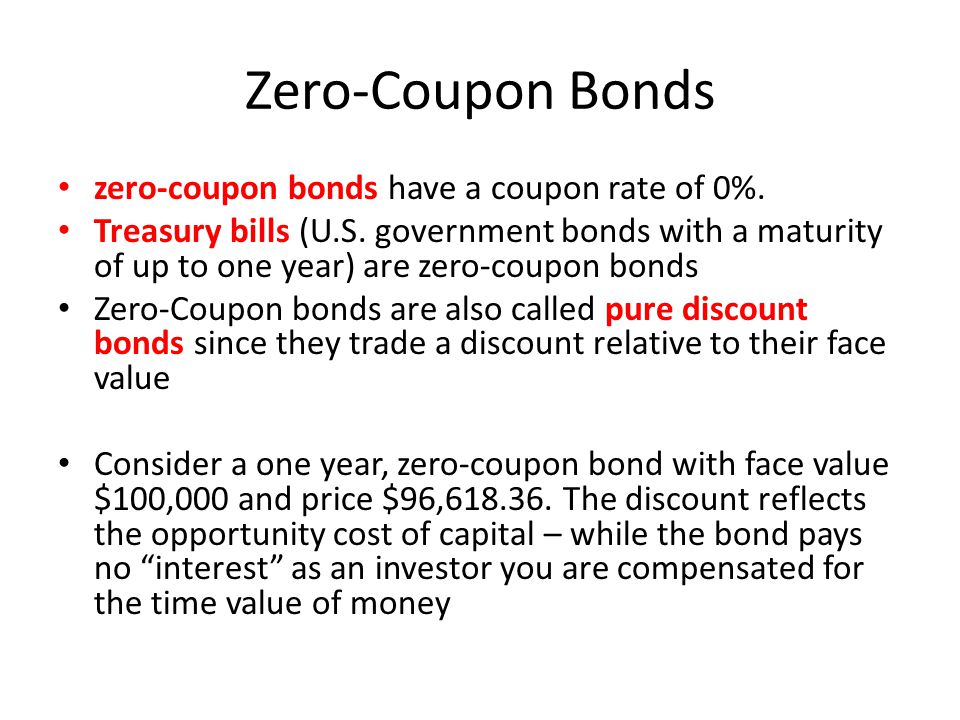

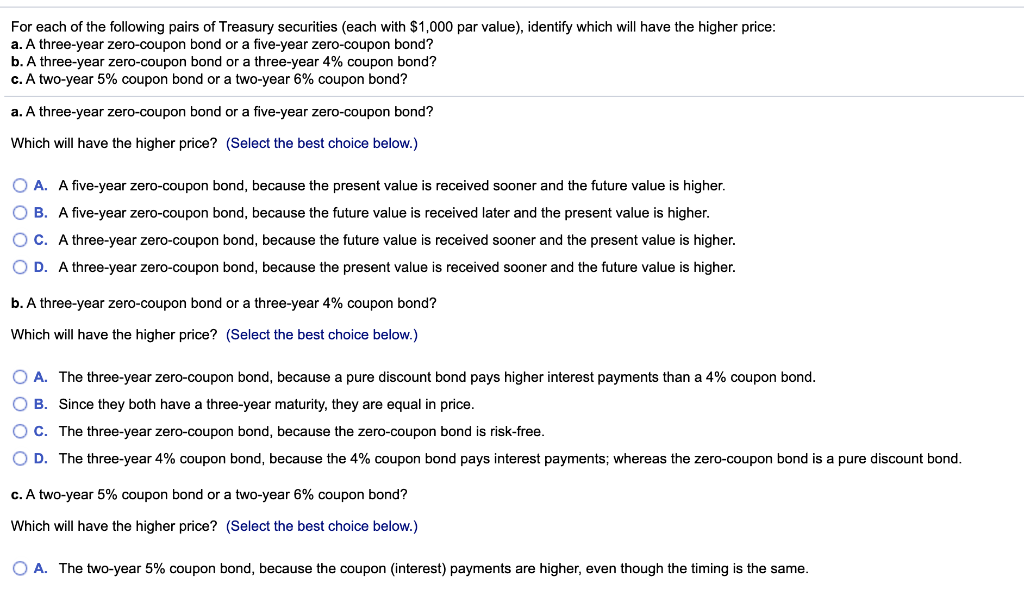

44 are treasury bills zero coupon bonds

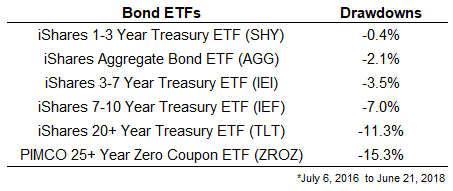

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall.1 However, ...

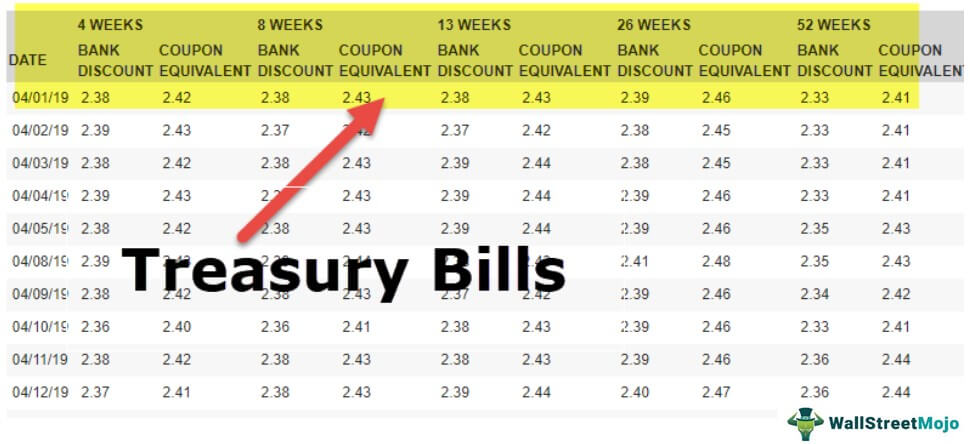

What Are Treasury Bills (T-Bills) and How Do They Work? The only interest paid will be when the bill matures. At that time, you are given the full face value. T-bills are zero-coupon bonds that are usually sold at a ...

Are treasury bills zero coupon bonds

Zero-coupon bond - Wikipedia When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US savings bonds, long- ... Treasury bills are also known as Zero Coupon Bonds that ... - Toppr Treasury bills are also known as Zero Coupon Bonds that are available for a minimum of and in multiples thereof. A treasury bill is basically an instrument ... Zero coupon Treasury securities - RBC Wealth Management What are zero coupon Treasuries? In general, a zero coupon bond is any bond which doesn't pay periodic interest. Earnings (interest).

Are treasury bills zero coupon bonds. What Is a Zero-Coupon Bond? Definition, Advantages, Risks Jul 28, 2022 ... A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. What's the difference between a zero-coupon bond and a Treasury ... T-bills do not pay any coupon. They are floated as a zero-coupon bond to the investors, they are issued at discounts, and the investors receive the face value ... Zero Coupon Bond - Investor.gov Sep 29, 2022 ... Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep ... Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest.

Zero coupon Treasury securities - RBC Wealth Management What are zero coupon Treasuries? In general, a zero coupon bond is any bond which doesn't pay periodic interest. Earnings (interest). Treasury bills are also known as Zero Coupon Bonds that ... - Toppr Treasury bills are also known as Zero Coupon Bonds that are available for a minimum of and in multiples thereof. A treasury bill is basically an instrument ... Zero-coupon bond - Wikipedia When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US savings bonds, long- ...

Post a Comment for "44 are treasury bills zero coupon bonds"