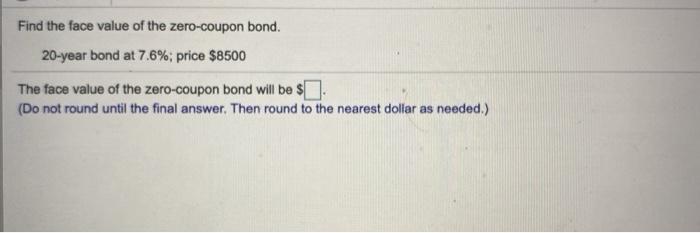

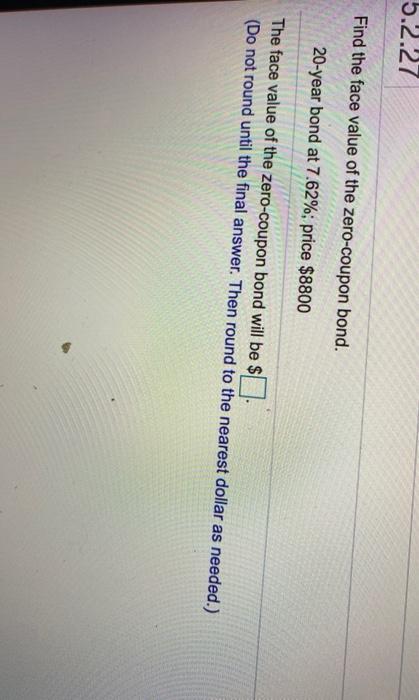

38 find the face value of the zero coupon bond

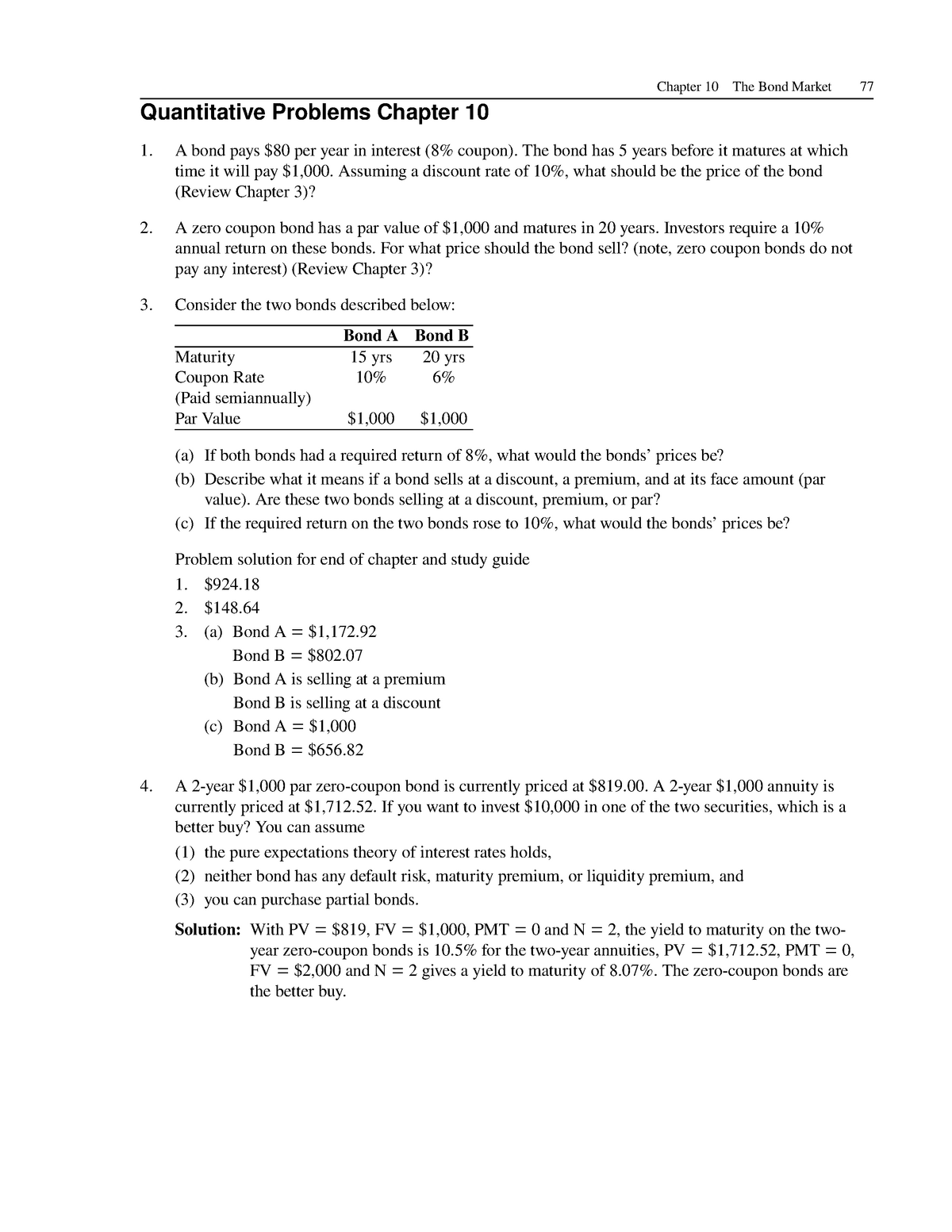

Zero Coupon Bond | Definition, Formula & Examples - Study.com Feb 18, 2022 ... The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 ... How to Calculate Yield to Maturity of a Zero-Coupon Bond Zero-coupon bonds do not pay interest at regular intervals. Instead, z-bonds are issued at a discount and mature to their face value. As a result, YTM ...

Zero-Coupon Bond Definition - Investopedia M = Maturity value or face value of the bond; r = required rate of interest; n = number of years until maturity. If an investor wishes to make a 6% return on ...

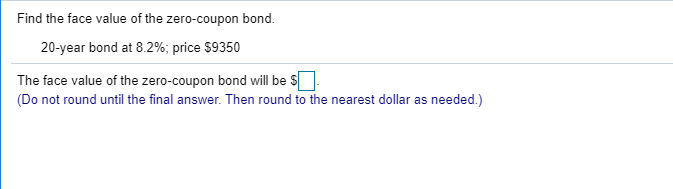

Find the face value of the zero coupon bond

Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... When the bond reaches a maturity date (the end of the bond period), the holder is entitled to receive the face value (a stated amount) of the ... Zero Coupon Bond Value Calculator - BuyUpside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield ... Zero Coupon Bond Value - Financial Formulas (with Calculators) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years.

Find the face value of the zero coupon bond. Calculate Zero-coupon Bond Purchase Price Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the ... Zero Coupon Bond Calculator - MiniWebtool A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest ... Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). Zero-Coupon Bond - Wall Street Prep Zero-Coupon Bond Price Formula ... To calculate the price of a zero-coupon bond – i.e. the present value (PV) – the first step is to find the bond's future value ...

Zero Coupon Bond Value - Financial Formulas (with Calculators) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. Zero Coupon Bond Value Calculator - BuyUpside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield ... Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... When the bond reaches a maturity date (the end of the bond period), the holder is entitled to receive the face value (a stated amount) of the ...

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "38 find the face value of the zero coupon bond"