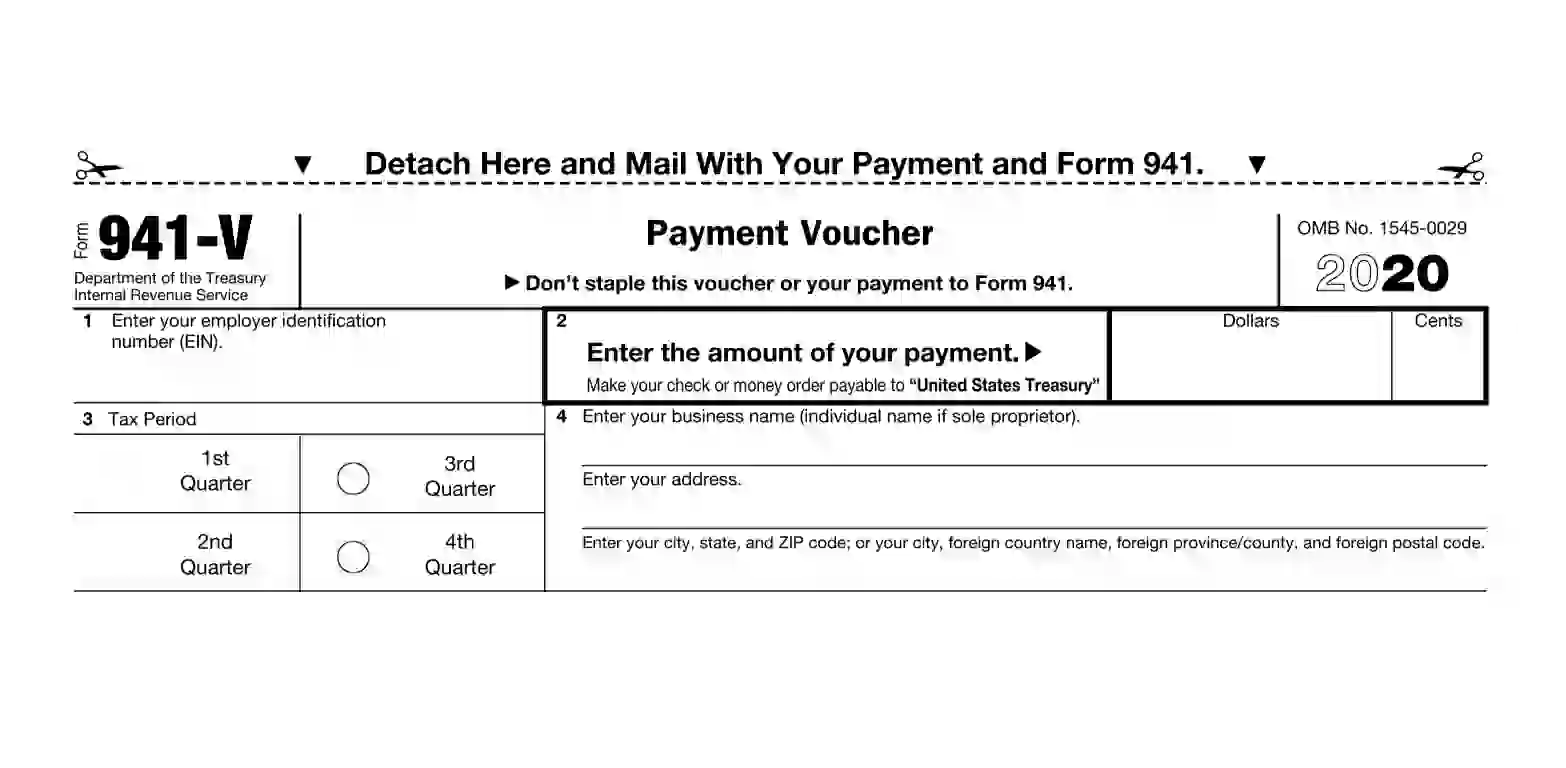

44 irs quarterly payment coupon

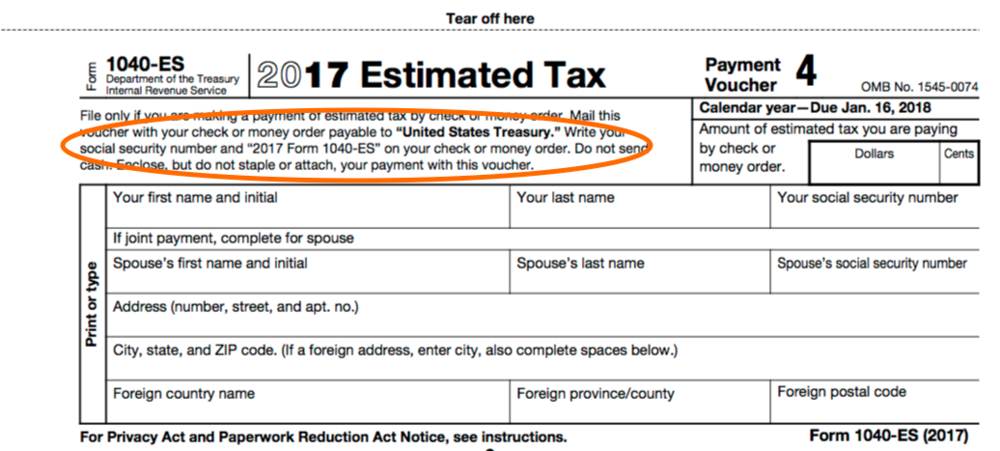

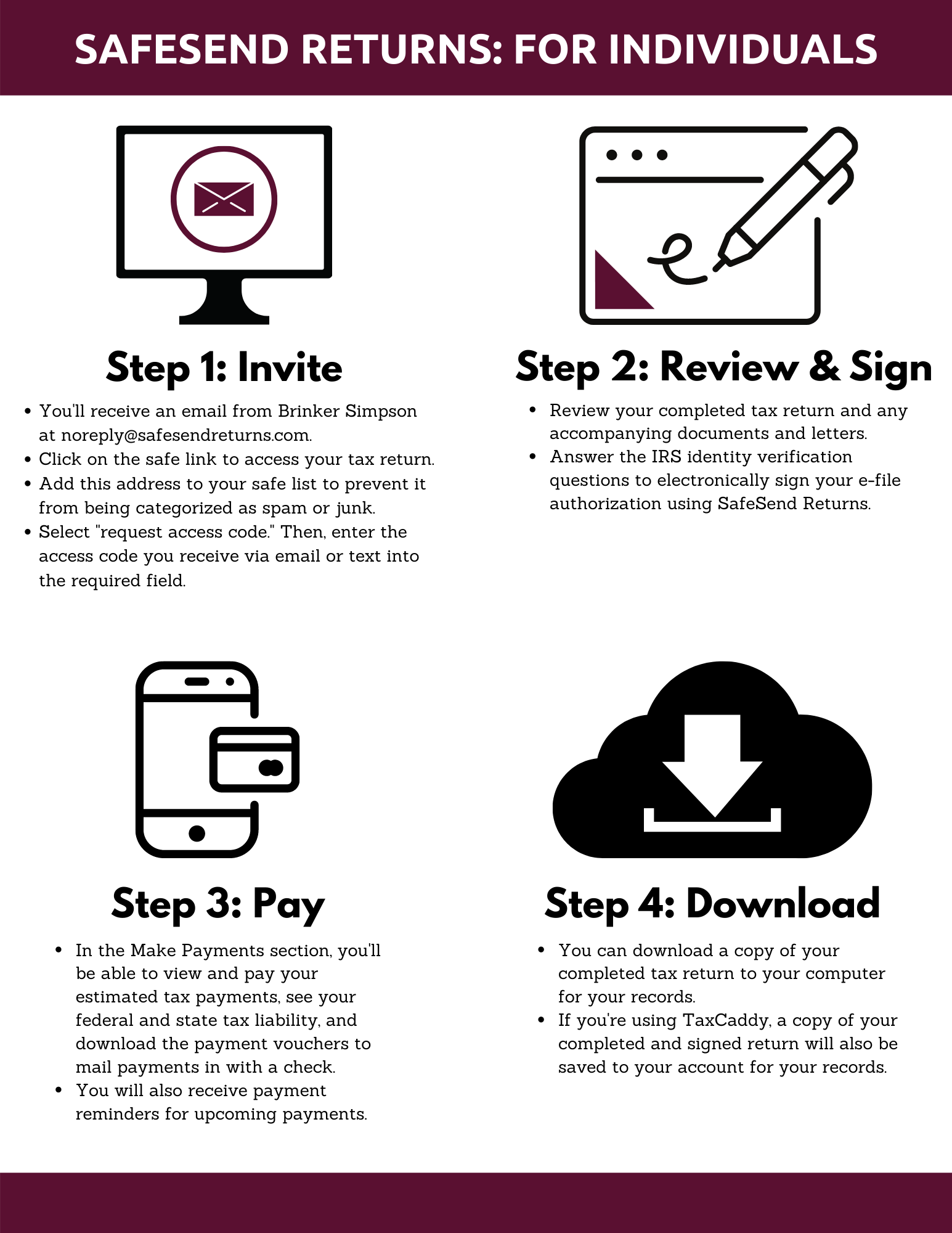

your.yale.edu › work-yale › financials2022 Federal Quarterly Estimated Tax Payments | It's Your Yale Jun 01, 2013 · 2. How do I make federal quarterly estimated payments? The IRS provides various methods for making 2022 quarterly estimated tax payments: You may credit an overpayment on your 2021 tax return to your 2022 estimated tax; You may mail your payment with payment voucher, Form 1040-ES; You may pay by phone or online (refer to Form 1040-ES instructions); IRS: Sept. 15 is the deadline for third quarter estimated tax payments ... IR-2022-157, September 6, 2022. WASHINGTON — The Internal Revenue Service reminds taxpayers who pay estimated taxes that the deadline to submit their third quarter payment is September 15, 2022. Taxpayers not subject to withholding, such as those who are self-employed, investors or retirees, may need to make quarterly estimated tax payments.

Free Now Irs Quarterly Payment Vouchers For 2022 Free Now irs quarterly payment vouchers for 2022 and more discounts & coupons from Free Now brand. Best Coupon Saving. Home; Top Stores. Target Zoro Macy's Old Navy Zulily Daily Steals Best Buy ... You can easily access coupons about "Free Now Irs Quarterly Payment Vouchers For 2022" by clicking on the most relevant deal below. › Irs Form ...

Irs quarterly payment coupon

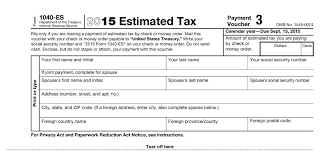

About Form 1040-ES, Estimated Tax for Individuals Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you do not elect voluntary withholding, you should make estimated tax payments on other taxable ... PDF Form CT-1040ES 2022 City, town, or post office State ZIP code Payment amount.00 See coupon instructions on back. (MM-DD-YYYY) Department of Revenue Services State of Connecticut Form CT-1040ES 2022 Estimated Connecticut Income Tax Payment Coupon for Individuals Complete this form in blue or black ink only. Please note that each form is year specific. Third quarter estimated tax payments due Sept. 15 IR-2020-205, September 9, 2020. WASHINGTON — The Internal Revenue Service today reminded the self-employed, investors, retirees and others with income not subject to withholding that third quarter estimated tax payments for 2020 are due September 15. Taxes are paid as income is received during the year through withholding from pay, pension or ...

Irs quarterly payment coupon. PDF Form IT-2105 Estimated Income Tax Payment Voucher Tax Year 2022 Enter applicable amount(s) and total payment in the boxes to the right. Print the last four digits of your SSN or taxpayer ID number and 2022 IT‑2105 on your payment. Make payable to NYS Income Tax. Mail voucher and payment to: NYS Estimated Income Tax, Processing Center, PO Box 4122, Binghamton NY 13902-4122. Enter your 2-character special How to Pay Quarterly Taxes: 2022 Tax Guide - SmartAsset Before outlining how to pay quarterly taxes, you must first understand who owes quarterly taxes and why the IRS requires them. The U.S. tax system uses a pay-as-you-go income tax system. With this type of system, taxpayers pay taxes as they earn income. Therefore, the government can tax W-2 employees with withholdings and self-employed ... mlvo.kinderbauernhof-boernicke.de › irs-estimatedIrs estimated tax payment online near Hoa Binh Jan 04, 2021 · Pay Irs Estimated Tax Payments Online. Submit the payment online through the electronic federal tax payment system; Track your payment with email notifications. Pay online by debit or credit card for a small “convenience fee.” use the electronic federal tax payment system (eftps), which you must enroll in but charges no fee. Yes, i know. › pub › irs-pdf2022 Form 1040-ES - IRS tax forms Internal Revenue Service Purpose of This Package Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you don't elect voluntary withholding,

Estimated Tax Payments Are Due Today. Who Needs to File, How to Submit ... Estimated taxes are paid quarterly, usually on the 15th day of April, June, September and January of the following year. One notable exception is if the 15th falls on a legal holiday or a weekend ... DOR Estimated Tax Payments | Mass.gov Unlike estimated payment vouchers, which have specific quarterly due dates, standard payment vouchers should only be used to submit a payment due with a tax return or amended tax return. Use a payment voucher when you are sending a paper check to DOR but your tax return has been filed electronically. › payPayments | Internal Revenue Service - IRS tax forms May 28, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. PDF 2022 Form OW-8-ES Oklahoma Individual Estimated Tax Year 2021 Worksheet ... estimated tax payment. Due Date: Enter the quarterly due date. See below for the due date for each quarter. Amount of Payment: Enter the amount of estimated tax being paid with the estimated tax coupon. Do not send coupon if no payment is required. Additional Information Make checks payable to: Oklahoma Tax Commission. Do NOT send cash.

Make a Payment | Minnesota Department of Revenue Individuals: Use the e-Services Payment System Some tax software lets you make or schedule payments when you file. To cancel a payment made through tax software, you must contact us. Call 651-556-3000 or 1-800-657-3666 (toll-free) at least three business days before the scheduled payment date. Businesses: Log in to e-Services About Form 1040-V, Payment Voucher | Internal Revenue Service Information about Form 1040-V, Payment Voucher, including recent updates, related forms and instructions on how to file. Submit this statement with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or Form 1040-SR, or 1040-NR. Estimated tax payments | FTB.ca.gov - California Generally, you must make estimated tax payments if in 2022 you expect to owe at least: $500. $250 if married/RDP filing separately. And, you expect your withholding and credits to be less than the smaller of one of the following: 90% of the current year's tax. 100% of the prior year's tax (including alternative minimum tax) For those who make estimated federal tax payments, the first quarter ... The 2022 Form 1040-ES, Estimated Tax for Individuals, can help taxpayers estimate their first quarterly tax payment. Income taxes are a pay-as-you-go process. This means, by law, taxes must be paid as income is earned or received during the year. Most people pay their taxes through withholding from paychecks, pension payments, Social Security ...

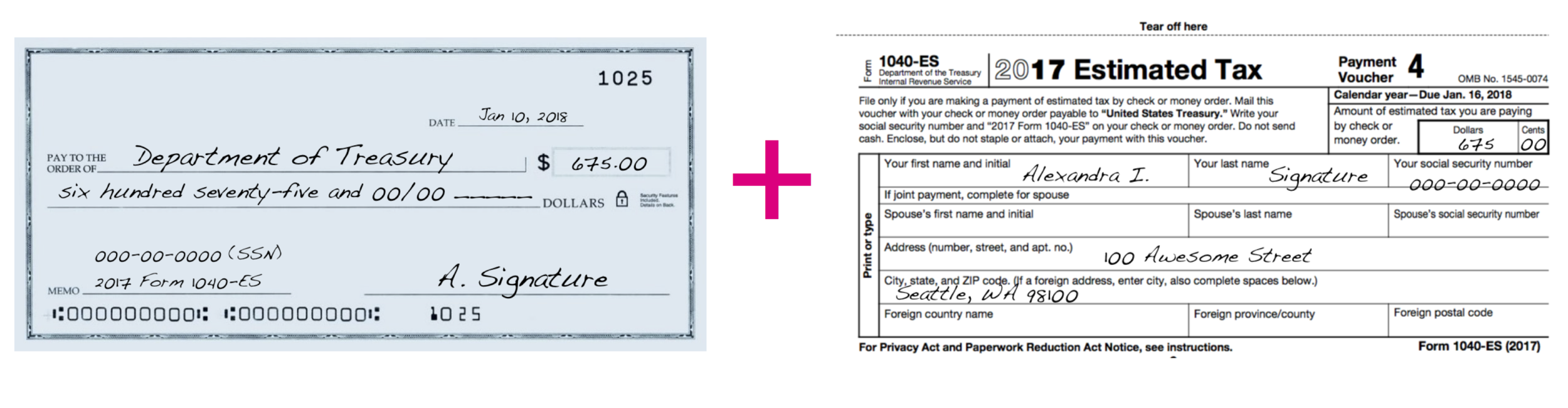

2022 1040-ES Form and Instructions (1040ES) - Income Tax Pro Roughly each quarter you will mail an estimated tax payment voucher with a check to the IRS. Here are the quarterly due dates for the 2022 tax year: April 18, 2022; June 15, 2022; September 15, 2022; January 17, 2023; Each quarterly estimated tax payment should be postmarked on or before the quarterly due date.

home.treasury.gov › newsPress Releases | U.S. Department of the Treasury Remarks by Under Secretary for Domestic Finance Nellie Liang During Webinar Hosted by Harvard Kennedy School’s Mossavar-Rahmani Center for Business and Government

PDF 2022 PA-40 ES INDIVIDUAL - Pennsylvania Department of Revenue DECLARATION OF ESTIMATED PERSONAL INCOME TAX DECLARATION OF ESTIMATED PERSONAL INCOME TAX (PA-40 ES) Use the 2022 Form PA-40 ES-I to make your quarterly estimated payment of tax owed. Do not use this voucher for any other purpose. Follow the instructions below. SOCIAL SECURITY NUMBER (SSN) SSN - enter the primary taxpayer's nine-digit SSN

› reviews › adp-payroll-reviewADP Review 2022 | Pricing, Costs, & Fees - Merchant Maverick May 26, 2022 · ADP has many features to help you manage your employees and contractors from a single interface. You can add job title, payment information, time off, tax documents, and benefits. ADP also allows you to manage additional earnings, deductions, and garnishments. HR newsletter; Employee verification; Time-off requests; New-hire form management ...

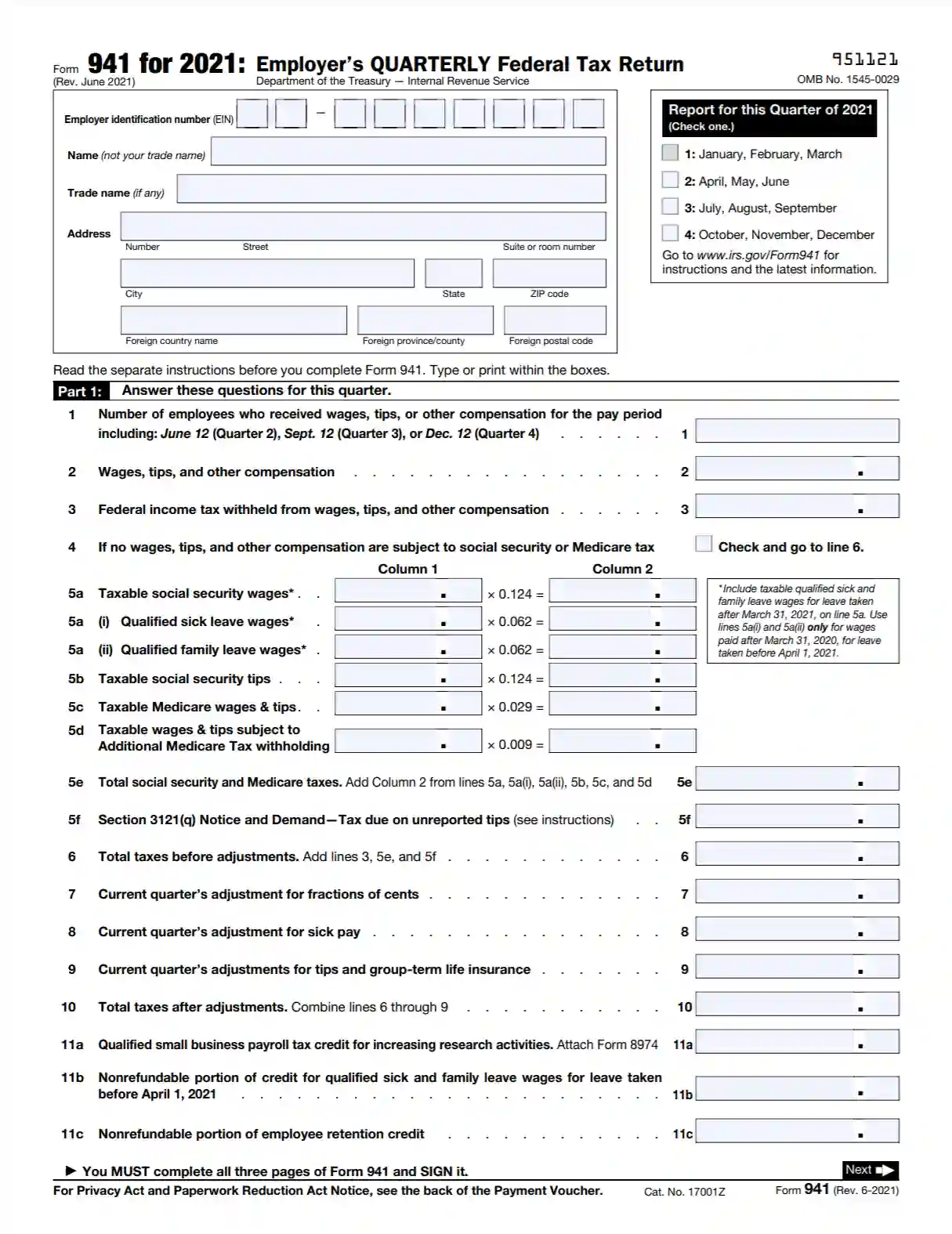

PDF Employer's Quarterly Tax Payment Coupon UIA 1028 (Employer's Quarterly Wage/Tax Report). Make your check/money order payable to: Unemployment Insurance Agency (UIA). In order to ensure your account is properly credited, please include your 10-digit UIA Employer Account Number on your check or money order. In order to avoid penalties and interest, your tax return and payment must be ...

Estimated Quarterly Tax Payments: 1040-ES Guide & Dates - TaxCure Tax Quarters 2022 Due Dates for Estimated Quarterly Tax Payments: Q1: Friday, April 18th, 2022. Q2: Wednesday, June 15th, 2022. Q3: Thursday, September 15th, 2022. Q4: Monday, January 17th, 2023. If you file your federal income tax return by the last day of January, you can skip the mid-January payment.

Third quarter estimated tax payments due Sept. 15 IR-2020-205, September 9, 2020. WASHINGTON — The Internal Revenue Service today reminded the self-employed, investors, retirees and others with income not subject to withholding that third quarter estimated tax payments for 2020 are due September 15. Taxes are paid as income is received during the year through withholding from pay, pension or ...

PDF Form CT-1040ES 2022 City, town, or post office State ZIP code Payment amount.00 See coupon instructions on back. (MM-DD-YYYY) Department of Revenue Services State of Connecticut Form CT-1040ES 2022 Estimated Connecticut Income Tax Payment Coupon for Individuals Complete this form in blue or black ink only. Please note that each form is year specific.

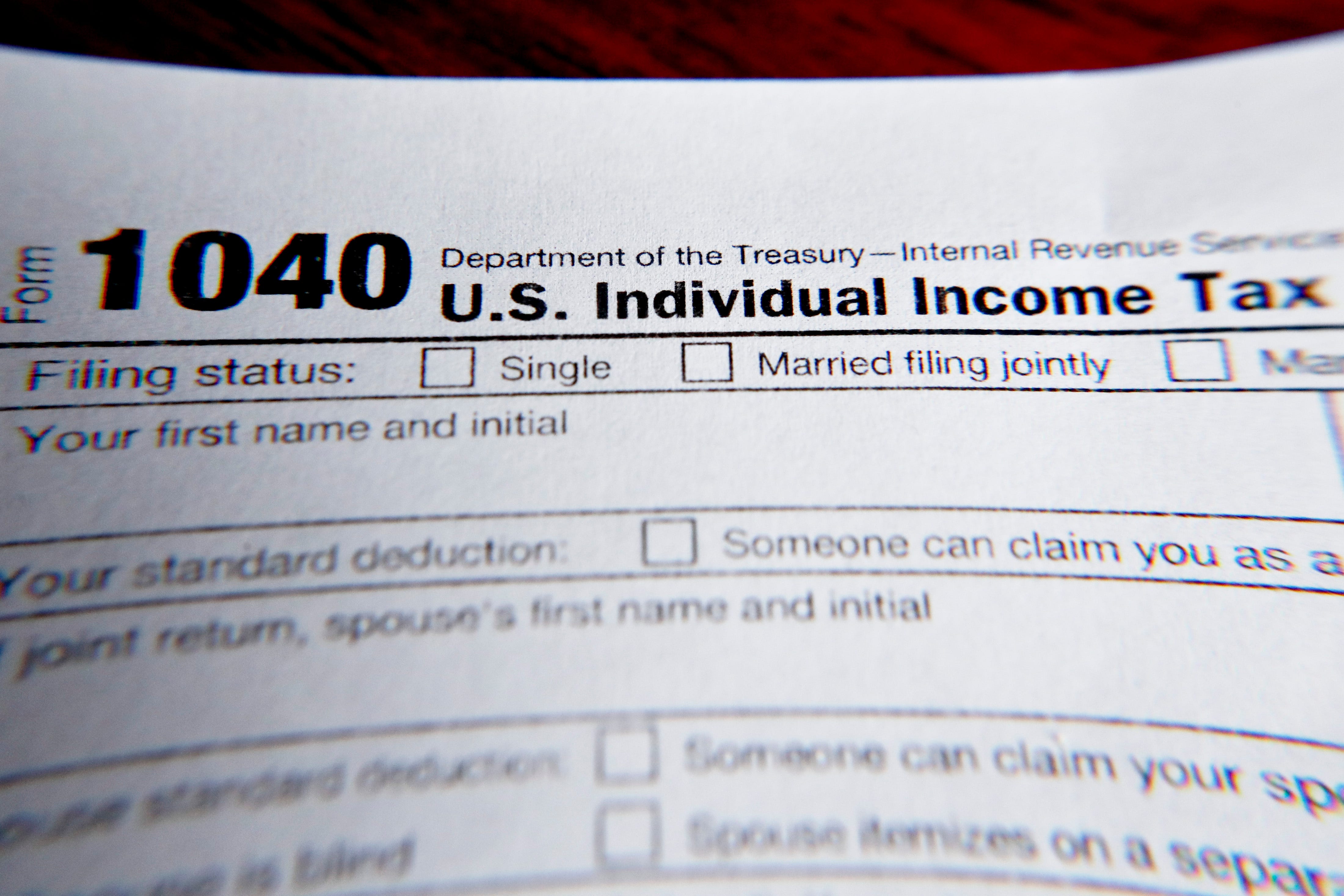

About Form 1040-ES, Estimated Tax for Individuals Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you do not elect voluntary withholding, you should make estimated tax payments on other taxable ...

/1040-V-df038816cc244b248641f447493a030d.jpg)

Post a Comment for "44 irs quarterly payment coupon"