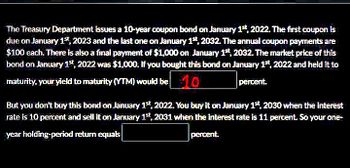

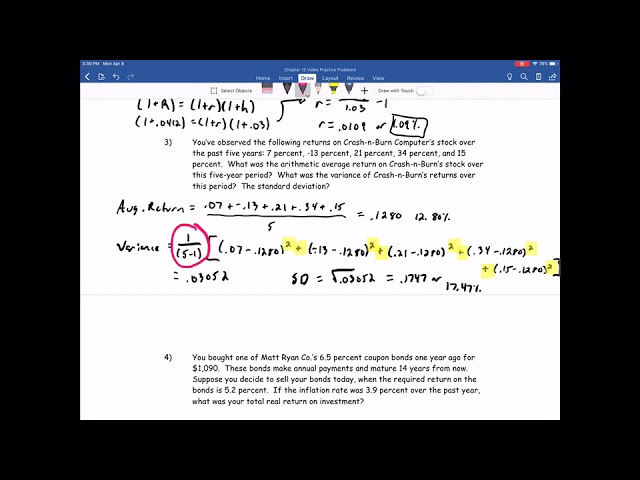

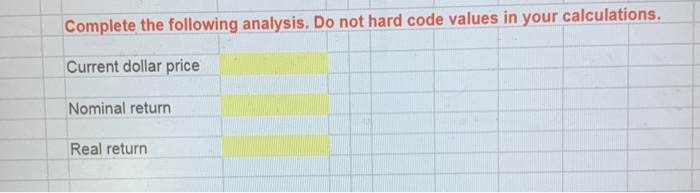

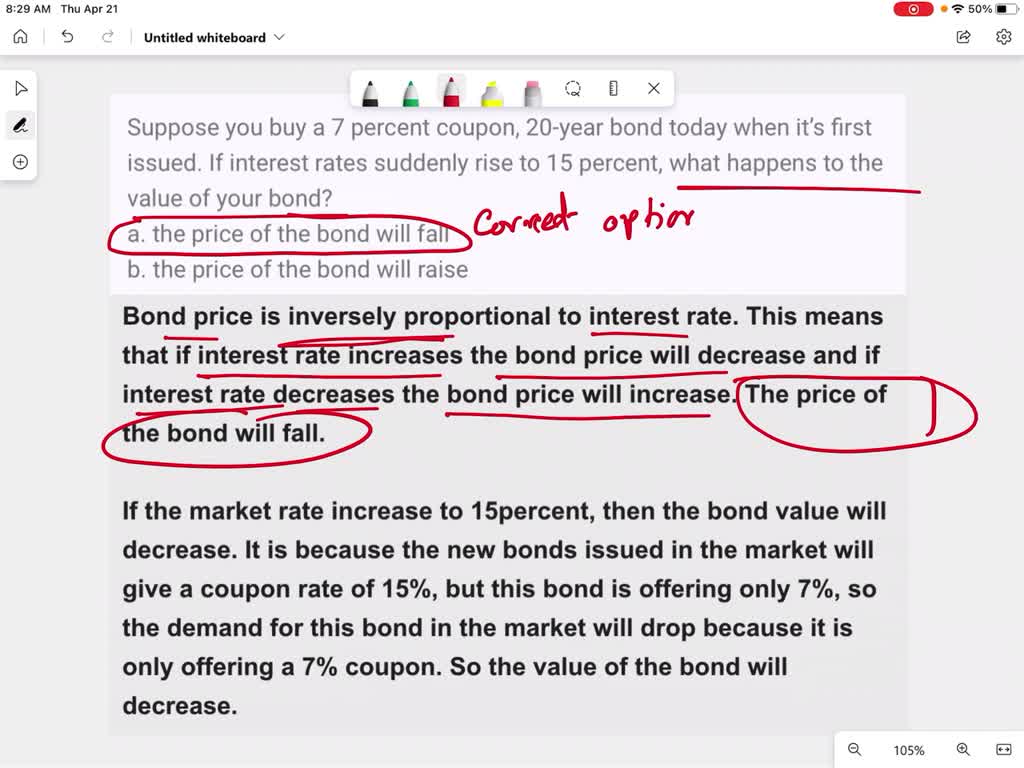

43 suppose you bought a bond with an annual coupon of 7 percent

Why Are Customer Reviews So Important? | by Revain - Medium WebNov 27, 2018 · But if you think that’s impressive, read on. Products with reviews are 270% more likely to be bought than a product without, according to Speigel Research Centre (2017). For a higher priced ... Answered: Mario bought a bond with a face amount… | bartleby WebMario bought a bond with a face amount of $1,000, a stated interest rate of 6%, and a maturity date 12 years in the future for $989. ... Last year Janet purchased a $1,000 face value corporate bond with a 7% annual coupon rate and a ... Suppose John purchased an annual coupon bond with a face value of $1000, a coupon rate of 8% and ...

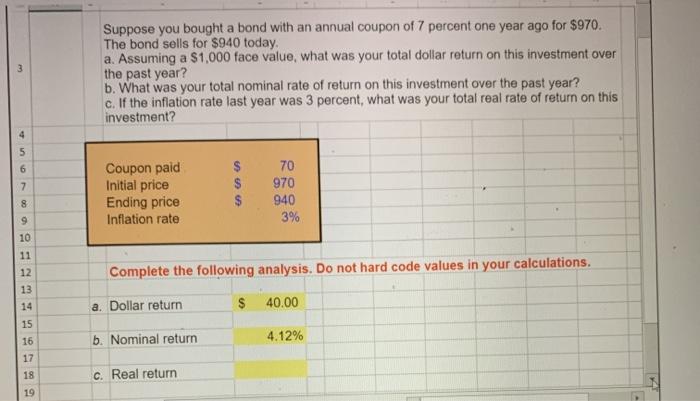

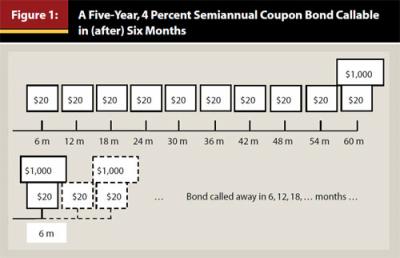

Accounting Terminology Guide - Over 1,000 Accounting and WebAug 10, 1993 · Coupon INTEREST rate on a DEBT SECURITY the ISSUER promises to pay to the holder until maturity, expressed as an annual percentage of FACE VALUE. Coupon Bond A BOND that is usually not registered with the issuing CORPORATION but instead bears interest coupons stating the amount of INTEREST due and the payment date.

Suppose you bought a bond with an annual coupon of 7 percent

Answered: A corporate bond maturing in 15 years… | bartleby WebQ: The 7 percent annual coupon bonds of the ABC Co. are selling for $950.41. The bonds mature in 8… The bonds mature in 8… A: Yield to maturity is the rate of return a bond generates in its lifetime assuming to be held till… How to Calculate Bond Total Return: 3 Ways to Assess the ... - wikiHow WebNov 05, 2020 · In either case, you still receive interest payments based on the face value and coupon rate of the bond. The annual interest payments on the bond are $50,000 ($500,000 * .10 = $50,000). When a bond matures, you get the face value of the bond. Whether you bought the bond at a discount or a premium, upon maturity you receive the face value. Join LiveJournal WebBy logging in to LiveJournal using a third-party service you accept LiveJournal's User agreement. Создание нового журнала ...

Suppose you bought a bond with an annual coupon of 7 percent. Best Custom Writing Services - Assignment Essays WebGet 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. Answered: Currently, the market interest rate on… | bartleby WebSuppose you purchase a 30-year Treasury bond with a 6% annual coupon, initially trading at par. In 10 years’ time, the bond’s yield to maturity has risen to 7% (EAR).a. If you sell the bond now, what internal rate of return will you have earned on your investment in the bond?b. We help students improve their academic standing - Achiever … WebEnsure you request for assistant if you can’t find the section. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area, number of pages, urgency, and academic level. After filling out the order form, you fill in the sign up details. Have your academic paper written by a professional - Course Help … WebEnsure you request for assistant if you can’t find the section. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area, number of pages, urgency, and academic level. After filling out the order form, you fill in the sign up details.

Join LiveJournal WebBy logging in to LiveJournal using a third-party service you accept LiveJournal's User agreement. Создание нового журнала ... How to Calculate Bond Total Return: 3 Ways to Assess the ... - wikiHow WebNov 05, 2020 · In either case, you still receive interest payments based on the face value and coupon rate of the bond. The annual interest payments on the bond are $50,000 ($500,000 * .10 = $50,000). When a bond matures, you get the face value of the bond. Whether you bought the bond at a discount or a premium, upon maturity you receive the face value. Answered: A corporate bond maturing in 15 years… | bartleby WebQ: The 7 percent annual coupon bonds of the ABC Co. are selling for $950.41. The bonds mature in 8… The bonds mature in 8… A: Yield to maturity is the rate of return a bond generates in its lifetime assuming to be held till…

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "43 suppose you bought a bond with an annual coupon of 7 percent"