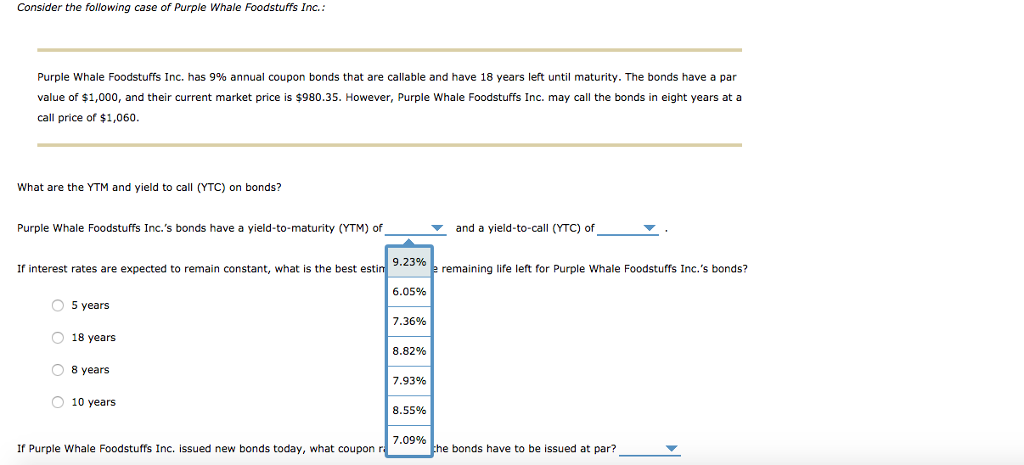

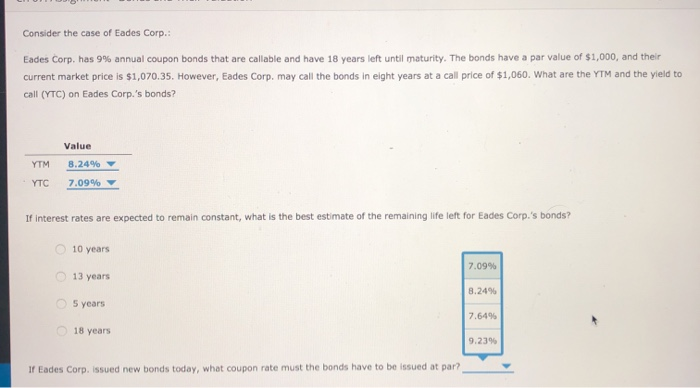

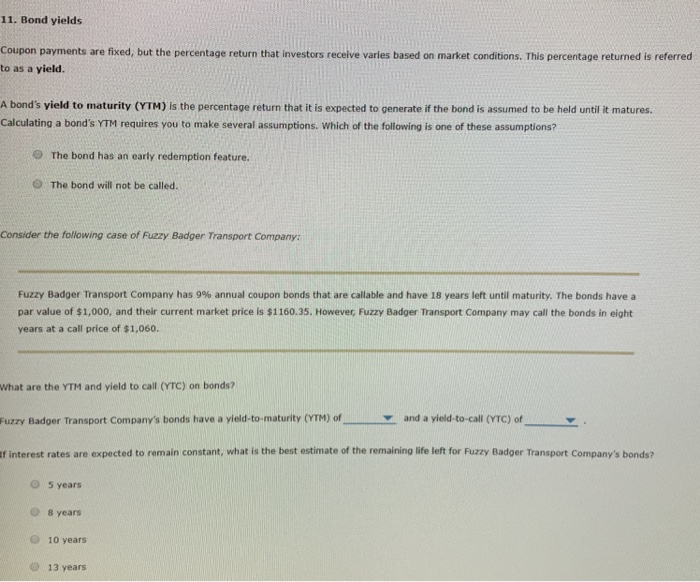

41 bond yield vs coupon rate

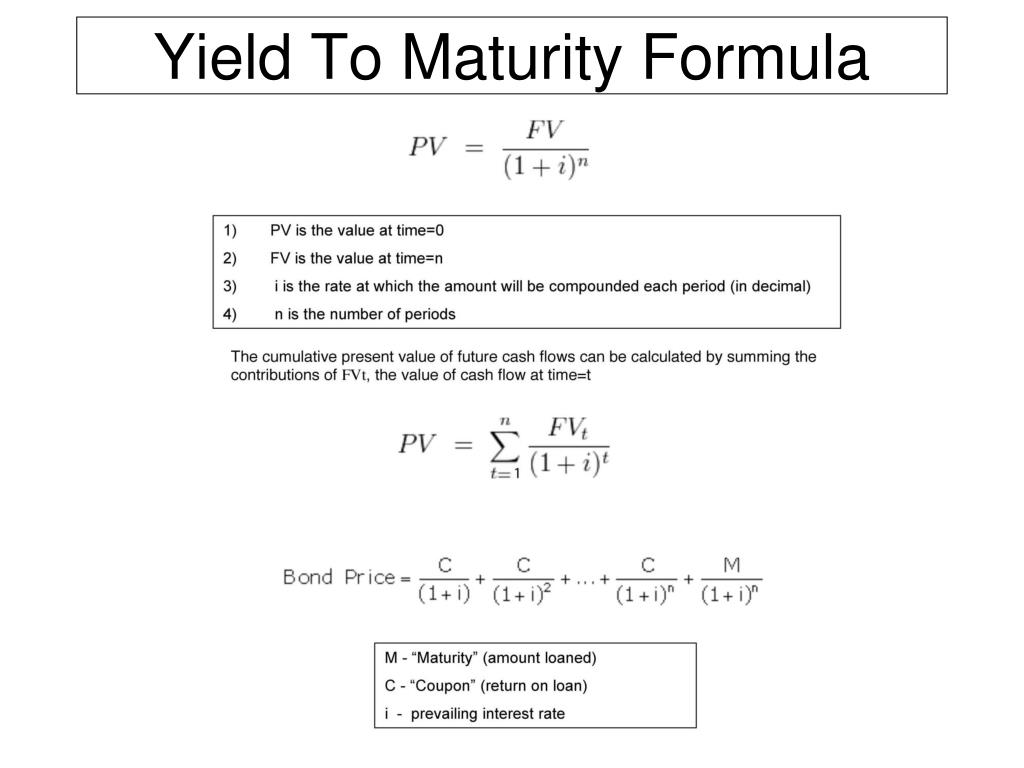

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Premium vs Discount Bonds: Which Should You Buy? - SmartAsset This means the coupon rate for the bond has fallen below wherever market rates are currently. Discount bonds can be attractive to investors who want to purchase bonds at a lower price. The discount price can help to offset lower yields associated with the bond. The deeper the discount, the higher the potential for gains from these bonds.

Bond yield vs coupon rate

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%. Following is the relationship between the bond prices with the couponrate and YTM. › mutual-funds › bond-vs-bond-fundsBonds vs Bond Funds - Fidelity Oct 06, 2021 · Another key differentiator of individual bonds is that they give you the ability to buy into a fixed rate of return, or “yield,” at the time of purchase. By calculating the future cash flows—based on the bond’s coupon and principal—as a function of the purchase price, it is possible to derive a total return or yield to maturity—or ... Bond Yield Rate Vs. Coupon Rate: What's The Difference? A bond's coupon fee is the velocity of curiosity it pays yearly, whereas its yield is the velocity of return it generates. A bond's coupon worth is expressed as a proportion of its par price. The par price is solely the face price of the bond or the price of the bond as acknowledged by the issuing entity.

Bond yield vs coupon rate. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be -. Coupon Rate = 5-Year Treasury Yield + .05%. So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5 ... Difference Between Bond Yield and Bond Price The main difference between Bond Yield and Bond Price is that the bond yield is the return on the bond investment, whereas the bond price is the monetary value of the particular bond. Both bond yield and bond price are interdependent and have an inverse relationship. Bonds have three basic parameters: Face value, Bond yield, and Bond price. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Difference Between Coupon Rate and Discount Rate Difference Between Current Yield and Coupon Rate; Coupon Rate vs Discount Rate. ... then, at that point, the bond buyer gets $100 consistently as coupon installments on the bond. On the off chance in which a bank has loaned $ 1000 to a client, and the Discount rate is 12%, then, at that point, the borrower should pay charges of $120 each year. ...

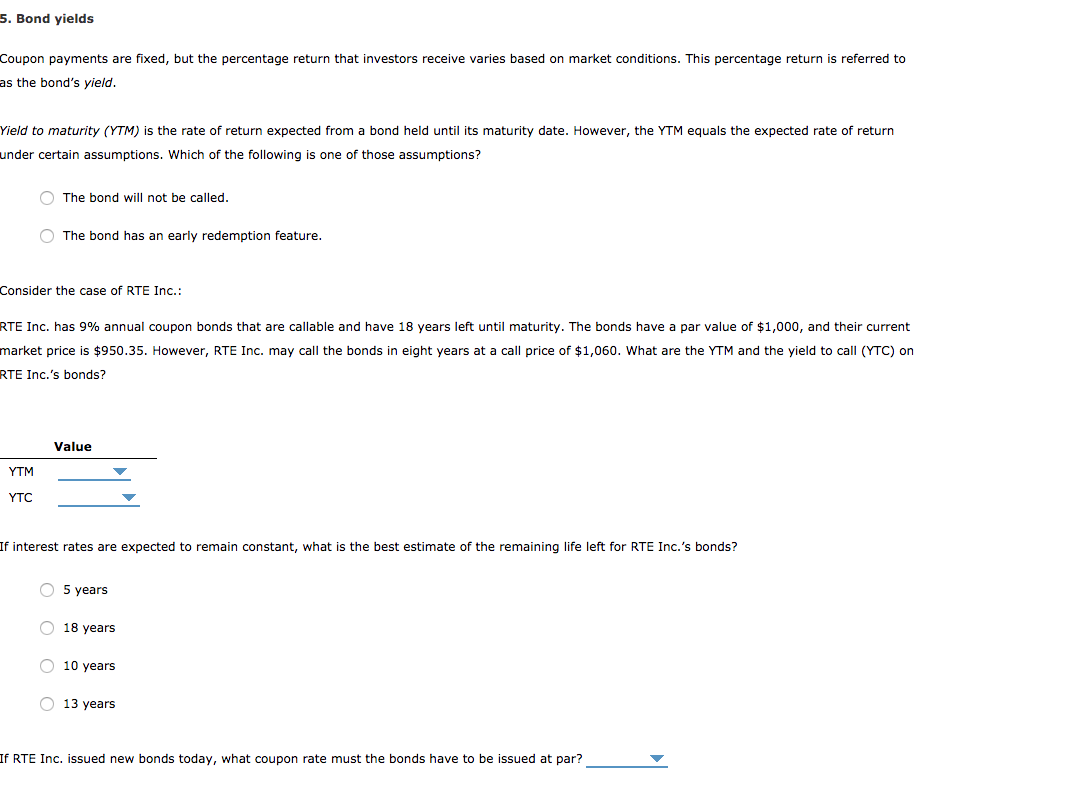

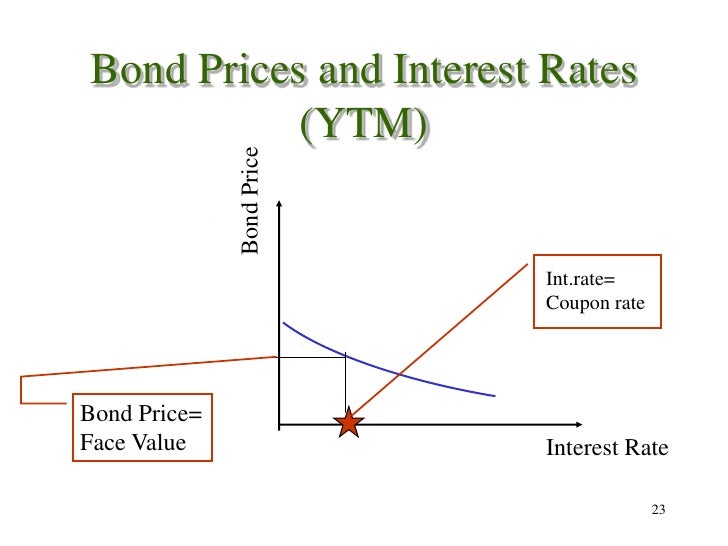

Bond Basics: How Interest Rates Affect Bond Yields The relationship between a bond's current price and its coupon is known as its yield, which is the amount of return an investor will realize on a bond, calculated by dividing its face value by its coupon. As market conditions affect a bond's price, its yield will also change. For example: As Bond Price Declines, Yield Increases › coupon-vs-yieldCoupon vs Yield | Top 5 Differences (with Infographics) Difference Between Coupon and Yield. Coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held till ... Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value. en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia An ABCXYZ Company bond that matures in one year, has a 5% yearly interest rate (coupon), and has a par value of $100. To sell to a new investor the bond must be priced for a current yield of 5.56%. The annual bond coupon should increase from $5 to $5.56 but the coupon can't change as only the bond price can change.

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value... What Is The Yield Curve? - Forbes Advisor You can calculate yield by dividing the coupon interest rate by a bond's current price in the secondary market: Yield = Annual Coupon / Bond Price. A yield curve is plotted on an X/Y axis. The ... Why Do Bond Prices and Yields Move in Opposite Directions? Bond prices and yields move in opposite directions, which you may find confusing if you're new to bond investing. Bond prices and yields act like a seesaw: When bond yields go up, prices go down, and when bond yields go down, prices go up. 1. In other words, an upward change in the 10-year Treasury bond's yield from 2.2% to 2.6% is a negative ... Difference Between Current Yield and Coupon Rate The main difference between current yield and coupon rate is that current yield is a ratio of annual income from the bond to the current price of the bond, and it tells about the expected income generated from the bond. In contrast, the coupon rate is a fixed interest paid by the issuer annually on the face value of a bond.

Bond ETFs and rising rates finally explained - Bankeronwheels.com On 19th September 2020, IEF Bond ETF quoted at 121.67 with a yield to maturity of 0.75%. Using the Bond ETF Calculator, let's simulate the following scenario for iShares IEF Bond ETF: Starting yield to maturity of the ETF is 0.75%. Rates rise over 2 years at a rate of 2% per annum.

en.macromicro.me › collections › 51Fed Funds Rate vs. US Treasury Yields | U.S. Treasury Bond ... = long-term bond yield The difference between 30- and 10-year bond yield may reflect inflation expectations over the long-term; 10- and 2-year bond yield spread, on the other hand, may reflect the direction of Fed's interest rate decision; 10- and 3-month bond yield spread may reflect current market liquidity.

Bond Yield: Definition, Formula, Understanding How They Work The coupon yield — or coupon rate — is the interest you earn annually from a bond. For example, if you bought a bond for $100 and earned $5 in interest per year, that bond would have a 5% ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? Bond Yield Rate vs. Coupon Rate: What's the Difference? By Messi. 19/07/2021. 214. Share. LINE. Facebook. Twitter. Pinterest. WhatsApp. Linkedin. ReddIt. Email. Tumblr. ... USD/JPY Gains as US Bond Yields Soar Ahead of Fed Liftoff. 15/03/2022. Gold Price Forecast: Potential Double Top Forms. 15/03/2022.

What is a Coupon Value? Definition and Calculation It is the interest rate paid by the issuer to investors. As market conditions change, the bond price changes, impacting the yield and changing the bond value. Bond yields reflect market conditions, but bond payouts remain fixed, hence the term fixed-income investment. A coupon rate reflects the amount investors can earn, allowing them to plan ...

What Is the Coupon Rate of a Bond? - The Balance In contrast to the bond's coupon rate, which is a stated interest rate based on the bond's par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond. In other words, the current yield is the coupon rate times the current price of the bond.

Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

› current-yield-of-a-bondCurrent Yield of a Bond - Meaning, Formula, How to Calculate? The current yield of a bond calculates the rate of return on a bond by using the market price of the bond instead of its face value. It is calculated as the annual coupon payment divided by the current market price The current yield is an accurate measure of bond yield as it reflects the market sentiment and investor expectations from the bond ...

Key Differences: Bond Price vs. Yield - SmartAsset To compensate for that, corporations issuing bonds at a lower rate must offer buyers a discount. Bond Price and Interest Rate Example. Let's say you purchase a bond from ABC Corp. that comes with a coupon rate of 5%. Three possibilities follow: The prevailing interest rate stays the same as the bond's coupon rate.

Coupon Rate Definition - Investopedia The coupon rate is the annual income an investor can expect to receive while holding a particular bond. It is fixed when the bond is issued and is calculated by dividing the sum of the annual...

› terms › bBond Yield Definition - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

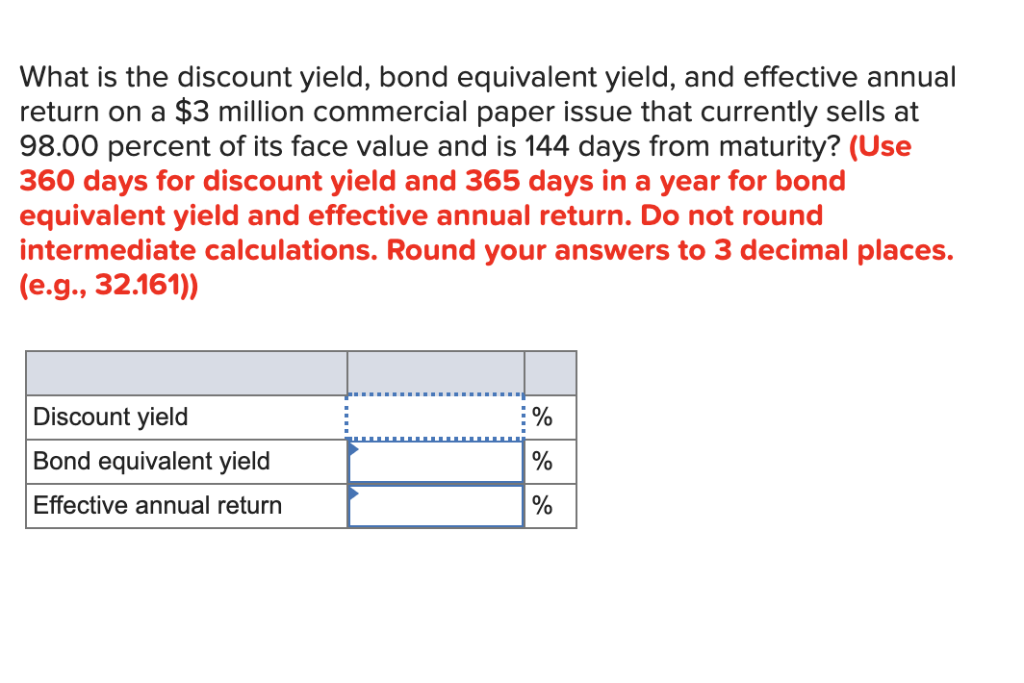

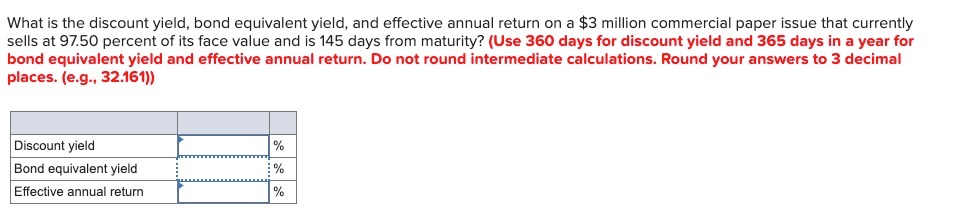

Effective Yield - Overview, Formula, Example, and Bond Equivalent Yield Effective Yield = [1 + (i/n)] n - 1 Where: i - The nominal interest rate on the bond n - The number of coupon payments received in each year Practical Example Assume that you purchase a bond with a nominal coupon rate of 7%. Coupon payments are received, as is common with many bonds, twice a year.

Current Yield vs. Yield to Maturity: What's the Difference? In contrast, the XYZ 3.15% bond's current market price is $980, a discount to the $1,000 face value. Its current yield of 3.2% and its yield to maturity of 3.48% are higher than its coupon rate because of the discount. While the current yield of one bond may be more attractive, the yield to maturity of another could be substantially higher.

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity.

Relationship Between Bond Yields, Interest Rates, and Inflation The coupon rate is basically the annual coupon payment divided by the face value of the bond. Bond yields and the price of a bond have an inverse relationship. There's an inverse relationship ...

Difference Between Coupon Rate and Interest Rate The main difference between Coupon Rate and Interest Rate is that the coupon rate has a fixed rate throughout the life of the bond. Meanwhile, the interest rate changes its rate according to the bond yields. The coupon rate is the annual rate of the bond that has to be paid to the holder. Also, it depends on the par value, that is, the face ...

Bond Yield Rate Vs. Coupon Rate: What's The Difference? A bond's coupon fee is the velocity of curiosity it pays yearly, whereas its yield is the velocity of return it generates. A bond's coupon worth is expressed as a proportion of its par price. The par price is solely the face price of the bond or the price of the bond as acknowledged by the issuing entity.

/GettyImages-182832748-af3f3d3824034fdaa66ac937fc2d7a40.jpg)

Post a Comment for "41 bond yield vs coupon rate"