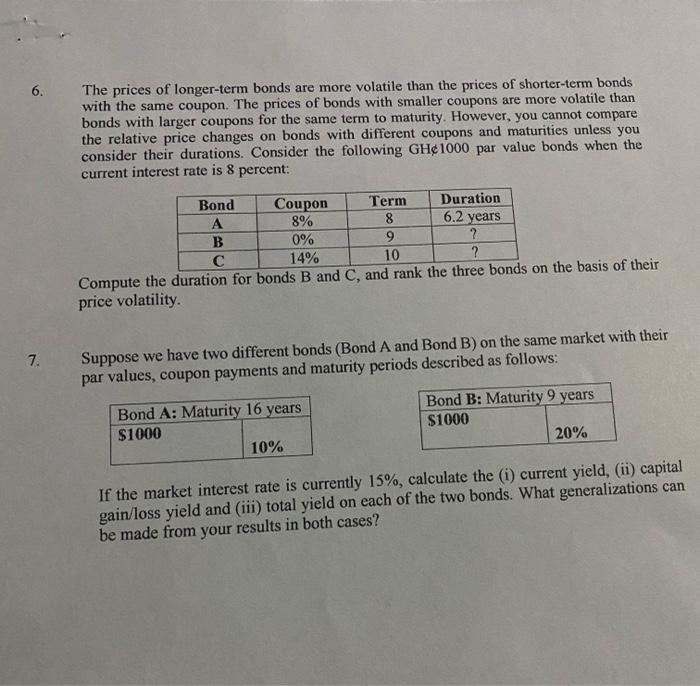

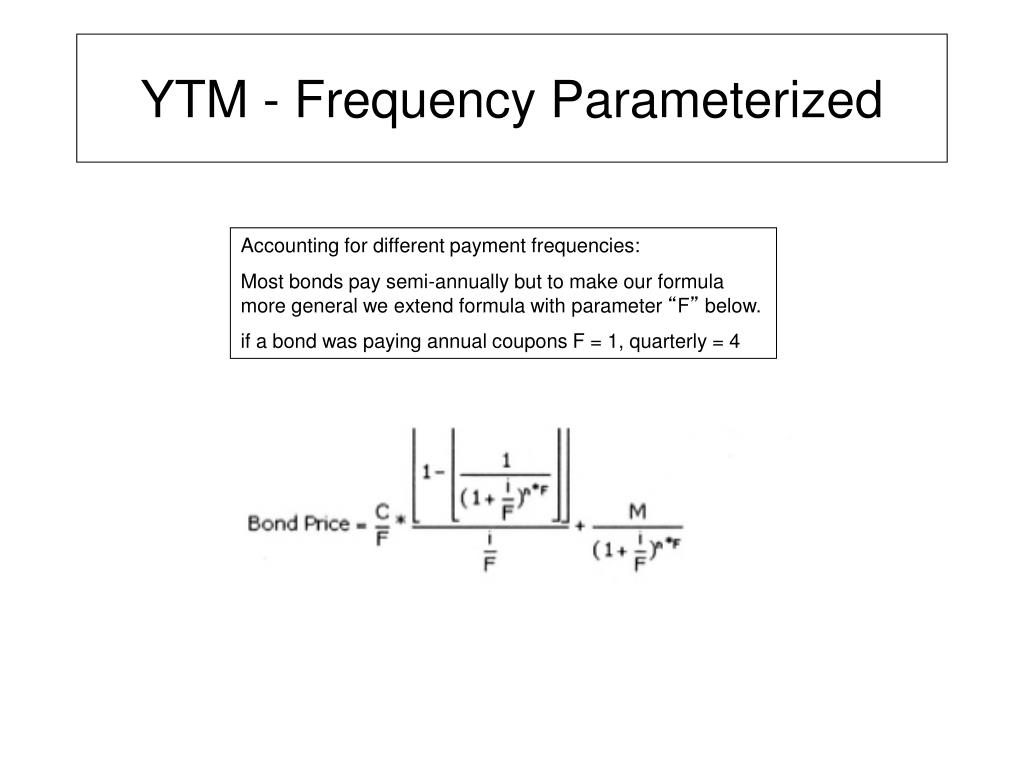

43 coupon paying bond formula

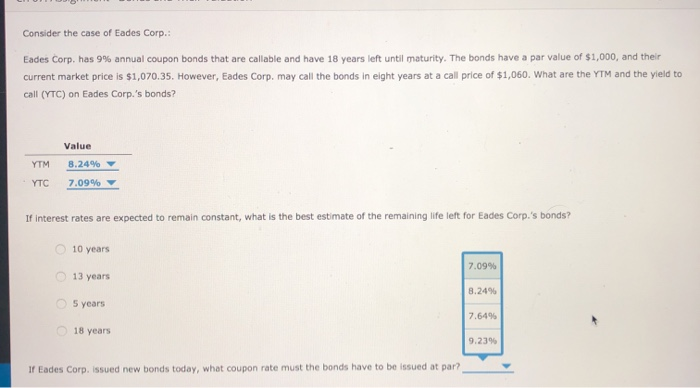

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Premium Bond Definition - Investopedia 21.03.2020 · Premium Bond: A premium bond is a bond trading above its par value ; a bond trades at a premium when it offers a coupon rate higher than prevailing interest rates. This …

Bond Value Calculator: What It Should Be Trading At | Shows Work! To illustrate why bond prices and market interest rates tend to move in opposite directions, suppose you purchased a 5-year, $1,000 bond at face value that was paying a 7% coupon rate. Now, suppose market interest rates rise , thereby causing bonds similar to yours to offer, say, an 8% coupon rate.

:max_bytes(150000):strip_icc()/latex_bcd659344016e1bd1d362dfdb0f92018-5c5076734cedfd0001ddb69d.jpg)

Coupon paying bond formula

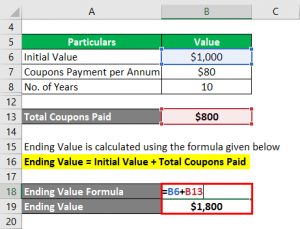

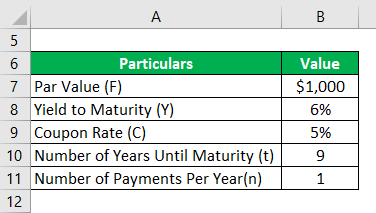

Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. How to Calculate PV of a Different Bond Type With Excel Feb 20, 2022 · Company 1 issues a bond with a principal of $1,000, paying interest at a rate of 5% annually with a maturity date in 20 years and a discount rate of 4%. The coupon is paid semi-annually: Jan. 1 ... Bond Valuation Overview (With Formulas and Examples) 20.08.2021 · Calculate the expected cash flows for the bond’s coupon. Discount the bond’s coupon cash flows to the present. Value each cash flow for the bond. The steps remain similar to valuing the same company with a discounted cash flow model; only we use the cash flows generated by the bond’s coupon and the bond’s face value. These both comprise ...

Coupon paying bond formula. Effective Interest Method - Overview, Uses, Formula 04.02.2022 · Formula for Calculating the Effective Interest Rate. The formula used to calculate the effective interest rate is as follows: Where: i = The bond’s coupon rate; n = The number of coupon payments per year (i.e., if coupon payments are received monthly, then n would be 12) More Resources. Thank you for reading CFI’s guide on Effective Interest Method. The following CFI resources will be ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Example Zero-coupon Bond Formula. P = M / (1+r) n. variable definitions: P = price; M = maturity value; r = annual yield divided by 2; n = years until maturity times 2 ; The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 ... Bond Formula | How to Calculate a Bond | Examples with Excel … Relevance and Use of Bond Formula. From the perspective of an investor or an analyst, it is important to understand the concept of bond pricing as bonds are an indispensable part of the capital market. In the bond market, bonds paying higher coupons attractive for investors as a higher coupon rate means higher yields. Further, bonds that trade ... Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples. Let us take the example of a bond with quarterly coupon payments. Let us assume a company XYZ Ltd has issued a bond having a face value of $1,000 and quarterly interest payments of $15. If the prevailing ...

Bond Valuation Overview (With Formulas and Examples) 20.08.2021 · Calculate the expected cash flows for the bond’s coupon. Discount the bond’s coupon cash flows to the present. Value each cash flow for the bond. The steps remain similar to valuing the same company with a discounted cash flow model; only we use the cash flows generated by the bond’s coupon and the bond’s face value. These both comprise ... How to Calculate PV of a Different Bond Type With Excel Feb 20, 2022 · Company 1 issues a bond with a principal of $1,000, paying interest at a rate of 5% annually with a maturity date in 20 years and a discount rate of 4%. The coupon is paid semi-annually: Jan. 1 ... Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Post a Comment for "43 coupon paying bond formula"