44 ytm for zero coupon bond

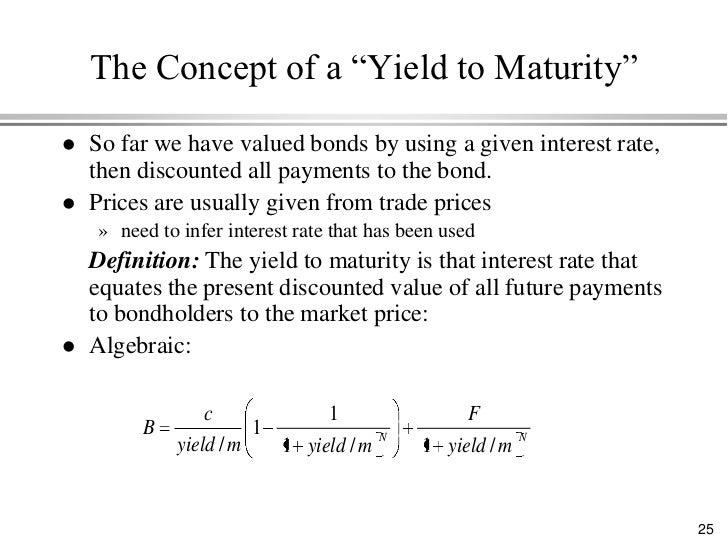

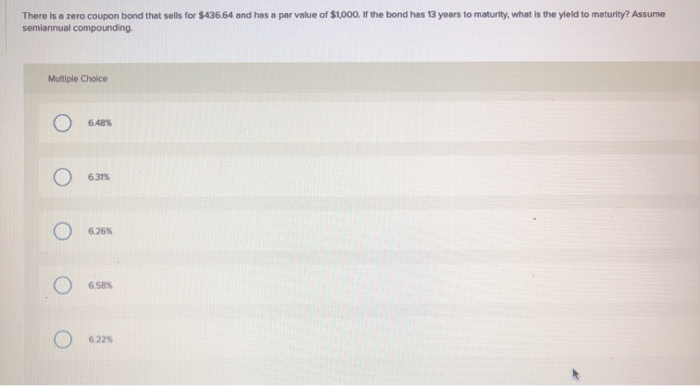

Zero Coupon Bonds - Financial Edge Training Value and YTM of Zero Coupon Bonds Bonds are valued by calculating the present value of future cash flows using an appropriate discount rate or interest rate. You can calculate the price of a bond using this formula: Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity Calculating the value of a zero coupon bond Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Yield to Maturity Calculator (YTM Calculator) - YTM Formula C = Bond Coupon Rate F = Bond Par Value P = Current Bond Price n = Years to Maturity. How to Calculate Yield to Maturity . To apply the yield to maturity formula, we need to define the face value, bond price and years to maturity. For example, if you purchased a $1,000 for $900. The interest is 8 percent, and it will mature in 12 years, we will plugin the variables. C = …

Ytm for zero coupon bond

Calculate the yield to maturity (YTM) for a zero | Chegg.com Finance questions and answers. Calculate the yield to maturity (YTM) for a zero coupon bond, if the bond are traded for 86160 SEK today and the time to expiration is 3 year (s). The face value of the bond is 100000 SEK. (Answers are rounded to one decimal) a) 10.1 % b) -4.8 % c) 95.2 % d) 5.1 % e) 105.1 %. Zero Coupon Bond | Definition, Formula & Examples - Video ... The yield to maturity on 1-year zero-coupon bonds is currently 4%; the YTM on 2-year zeros is 4.5%. The Treasury plans to issue a 2-year maturity coupon bond, paying How to Calculate PV of a Different Bond Type With Excel 20.02.2022 · A. Zero Coupon Bonds Let's say we have a zero coupon bond (a bond which does not deliver any coupon payment during the life of the bond but sells at a discount from the par value) maturing in 20 ...

Ytm for zero coupon bond. Bond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: Zero Coupon Bond Definition and Example | Investing Answers Zero coupon bonds are sensitive to interest rate fluctuations. The price you can get on the open market will be determined by current interest rates. If you purchased a zero coupon bond at 5% and interest rates rose and offered a 10% yield, your zero coupon bond won't look as attractive because of the lower return. Yield to Maturity - YTM vs. Spot Rate. What's the Difference? Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows:... Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

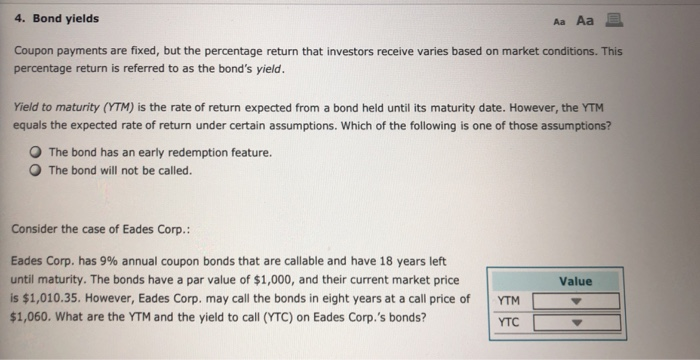

Yield to Maturity (YTM) Definition - investopedia.com Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92 market price = 5.21%. To calculate YTM here, the cash flows must be determined first. Every six months... Current Yield: Bond Formula and Calculator [Excel Template] Since the annual coupon depends on the bond’s original face value (FV), the coupon can be calculated by multiplying the coupon rate by the FV of the bond. Annual Coupon = $60; However, the current market prices of the bonds are all different, with the bonds trading below par, at par, and above par, respectively: Discount Bond = $950; Par Bond ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Solved What is the yield to maturity (YTM) of a zero ... What is the yield to maturity (YTM) of a zero coupon bond with a face value of $1,000, current price of $770 and maturity of 4 years? Recall that the compounding interval is 6 months and the YTM, like all interest rates, is reported on an annualized basis. (Allow two decimals in the percentage but do not enter the % sign.) STEP BY STEP

Zero Coupon Bond - Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. Zero Coupon Bond Yield Calculator - YTM of a discount bond A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Solved The YTM for a zero-coupon bond is 10.50% for a 1 ... The YTM for a zero-coupon bond is 10.50% for a 1-year bond and 11.2% for a 2-year bond. You wish to make a 1-year investment and obviously can buy the 1-year bond and hold it to maturity. Suppose, however, that you think the yield curve will remain the same throughout the future.

CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL | Dr ... In this lecture I am explaining how to #TYM#YieldToMaturity#HOW_TO_CALCULATE_YIELD_ON_ZERO_COUPON_BOND #YTM_IN_EXCEL calculate the yield on zero COUPON bond ...

Yield to Maturity (YTM) Definition 06.09.2021 · Calculations of yield to maturity (YTM) assume that all coupon payments are reinvested at the same rate as the bond's current yield and take into account the bond's current market price, par value ...

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero Coupon Bond Yield: Formula, Considerations, and ... The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

The Zero Coupon Bond: Pricing and Charactertistics ... "Zero Coupon Bond" or "Strip Bond" are bonds that are created by "stripping" a normal bond into its constituent parts: the "Coupons" and "Residual" or "Resid". An investment dealer will first buy a bond and then "strip" it. The individual coupons are the semi-annual interest payments due on the bond prior to maturity.

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Post a Comment for "44 ytm for zero coupon bond"